Tax Trends - Summer 2023

22 Sept, 202310 minsTax recruitment has gained momentum this summer. I thought it would be helpful to share my insights on what the tax job market looks like in the UAE at the moment.

Keeping my ears to the ground, I can promise an honest overview and guidance on the points below -

- Sharp hike in 𝗜𝗻𝗱𝘂𝘀𝘁𝗿𝘆 𝗿𝗼𝗹𝗲𝘀

- Trends in 𝗖𝗼𝗻𝘀𝘂𝗹𝘁𝗶𝗻𝗴 𝗿𝗼𝗹𝗲𝘀

- 𝗦𝗽𝗲𝗰𝗶𝗮𝗹𝗶𝘇𝗮𝘁𝗶𝗼𝗻 in demand

- The most frequently asked question - 𝗦𝗮𝗹𝗮𝗿𝘆 𝗯𝗲𝗻𝗰𝗵𝗺𝗮𝗿𝗸𝗶𝗻𝗴 in Industry

- Trends in 𝗵𝗶𝗿𝗶𝗻𝗴 𝗹𝗲𝘃𝗲𝗹𝘀 - Leadership roles vs junior / mid-senior roles

- 𝗖𝗵𝗮𝗹𝗹𝗲𝗻𝗴𝗲𝘀

- 𝗧𝗶𝗺𝗲𝗹𝗶𝗻𝗲𝘀 - Preference for immediate joining

- And lastly, is the tax market getting more 𝗰𝗼𝗺𝗽𝗲𝘁𝗶𝘁𝗶𝘃𝗲??

Summer was at the peak last month, and so was the tax jobs market! August was the busiest month of the year so far, with a sharp hike in demand for experienced tax professionals.

Whilst summers are usually slow from a recruitment perspective, it has been a completely different picture for tax. That is not surprising, given that the Corporate Tax regime has been introduced quite recently.

Tax Recruitment Trends

H1 of 2023 was largely focused on Tax roles in Consultancies, particularly the mid-sized consultancies and boutique tax firms. Consulting firms have been strengthening their Corporate & International Tax and Transfer Pricing practices given the potential business requirements.

However, as we stepped in H2 of the year, we have seen a sharp hike in in-house tax roles, which is evident from the graph below –

We have witnessed roughly 150% increase in in-house tax roles (until mid Q3) in comparison with the previous full quarter.

Although there is still a heavy reliance on Consulting firms, we see a lot of businesses (particularly in the mid-sized segment) looking for a tax specialist on board.

The requirement is largely for a Tax Manager or an Assistant Tax Manager to independently handle the function and liaise with external consultants.

Considering that we still have few weeks until the end of the quarter, we expect a huge pool of in-house tax jobs to open up in the coming weeks.

Timelines

Another interesting trend that I am seeing is that most businesses are looking for tax professionals with a shorter notice period or those who are available to join immediately.

This poses a challenge as many consultancies in this region have a 3 month notice period, which may or may not be negotiable, given the volume of work and the handover required.

As such, it is crucial for businesses to plan in advance if they are keen to have in-house specialists.

Specialism

While an in-house tax professional is largely expected to be a tax generalist to manage the overall tax function of the business, however, we see an emphasis being placed on Transfer Pricing experience. 50% of the in-house tax roles that I am working on require a transfer pricing specialization.

Of course, this is more so where the businesses have a huge volume of cross border transactions (example – global businesses following a distribution model, financial services etc.)

So, the demand for Transfer Pricing specialists continues to grow. Preference is given to those having a regional experience and sectoral knowledge.

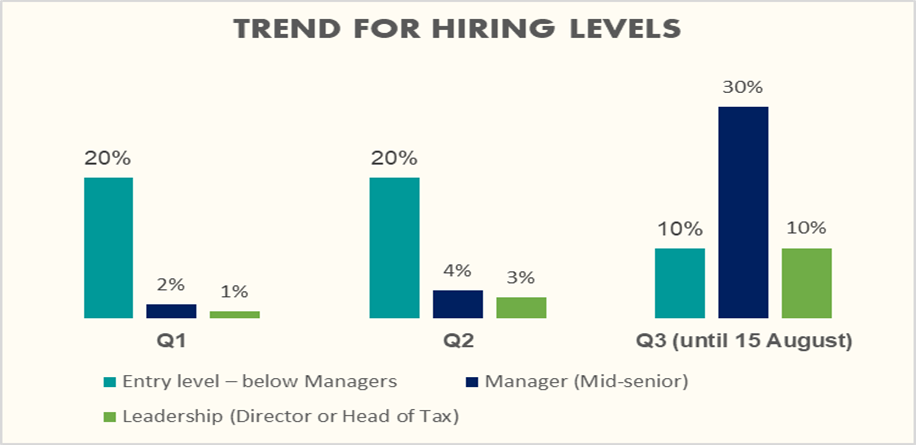

Trend for hiring levels in an in-house role

This data merely shows the trends in industry roles. We can see that there is a huge demand for Tax Managers and below, and it tapers down at leadership roles.

We are in touch with a lot of CFOs and we understand that many mid-sized businesses prefer to hire mid-senior level tax specialists who can independently manage the tax function and report directly to the Head of Finance or the CFO. We expect to see more leadership roles opening up in Q1 of 2023.

Salary

I have been asked this question innumerable times by candidates as well as hiring managers recruiting a tax role for the first time in the organization.

While there is no benchmarking for tax salaries in industry, however, the matrix below would be helpful for candidates to have an idea about the market standards.

The salary range above is only indicative. It depends on several other factors like the roles or responsibilities, the benefits provided, bonus policy, size of the organization etc.

Furthermore, candidates having regional experience or sectoral knowledge are in a better position to command a premium on their existing pay.

Businesses need to realize the value a tax specialist can bring on board and need to fix the budget at par with the market standards to attract and retain talent.

Trends in Consulting

I have mainly discussed trends in Industry roles in this article, but I would also like to give a quick update on Consulting roles as well.

Consultancies continue to face a high rate of attrition of employees. There is a huge demand for tax professionals at junior levels in Indirect Tax and Transfer Pricing.

In order to ensure continuity of work and handover, preference is given to candidates who are immediately available to join or are on a shorter notice period.

Challenges

As a tax recruiter, I often need to work within the fixed budget set by businesses for the role. Having been a tax professional in the past, I fully appreciate the importance of the role within the business.

A candidate may fit within a lower budget, however, it is also important to consider whether the candidate is experienced enough to handle a global tax function independently.

Along with technical expertise, interpersonal skills, experience in handling stakeholders and the presence of mind to manage difficult situations are equally important.

I believe that this only comes with experience and of course, that comes at an additional cost. So, finding the right candidate to fit in a certain budget can be a huge challenge at times.

Also, it often becomes a challenge to find candidates who are able to join in a short time frame of 1-2 months.

Competitive market

Towards the end of Q2 and early Q3, a number of startups have mushroomed, catering to the tax requirements of businesses.

In addition, several consulting firms or law firms, which were not traditionally into Tax, are building up their tax practices and are being led by experienced tax advisors.

With this, the market is becoming highly competitive. Once the brouhaha over the new Tax laws settles down, only time will tell whether tax consultancies can have a sustainable practice in the long run.

Conclusion

Hope you found this information insightful and relevant. Watch out for our upcoming series of Tax Podcasts with senior tax leaders, where we will be engaging in a candid conversation on various topics.

Please reach out to me on rhardikar@alchemysearch.ae if you have any questions or would like to know more about the tax jobs market in the UAE.